How to Calculate Company Car Tax

Guide - 5 min read

Recent changes to the company car tax regime have been beneficial for electric cars. Find out more in our step-by-step guide.

Guide - 5 min read

Recent changes to the company car tax regime have been beneficial for electric cars. Find out more in our step-by-step guide.

Podcast

In our latest podcast Matt Walters and Caroline Sandall-Mansergh take a look at what we might see in 2022 and how fleets can plan for the potential challenges ahead.

Guide - 2 min read

Download the 2020/21 fleet funding and taxation guide from LeasePlan UK. The report, produced in association with Deloitte, includes analysis, insights and details how latest tax legislation could impact your fleet and business.

Guide

Stay up-to-date with all the latest information for company car drivers, including tax, driver safety advice and tips with our Driving Insights Newsletter.

More

Report - 4 min read

New survey reveals that up to half of HR bosses and business leaders are unaware of the cost savings associated with electric vehicles (EVs) on salary sacrifice schemes.

3 min read

Join our webinar to get an in depth guide to all the latest company car and fleet related changes - here are the highlights of the most recent changes.

3 min read

Read our letter to the Prime Minister urging the Government to provide future certainty around the status and lifespan of the Plug In Car and Van Grants.

3 min read

What will the Johnson premiership mean for fleets and for transport-users in general? In truth, there aren’t many solid answers… yet.

5 min read

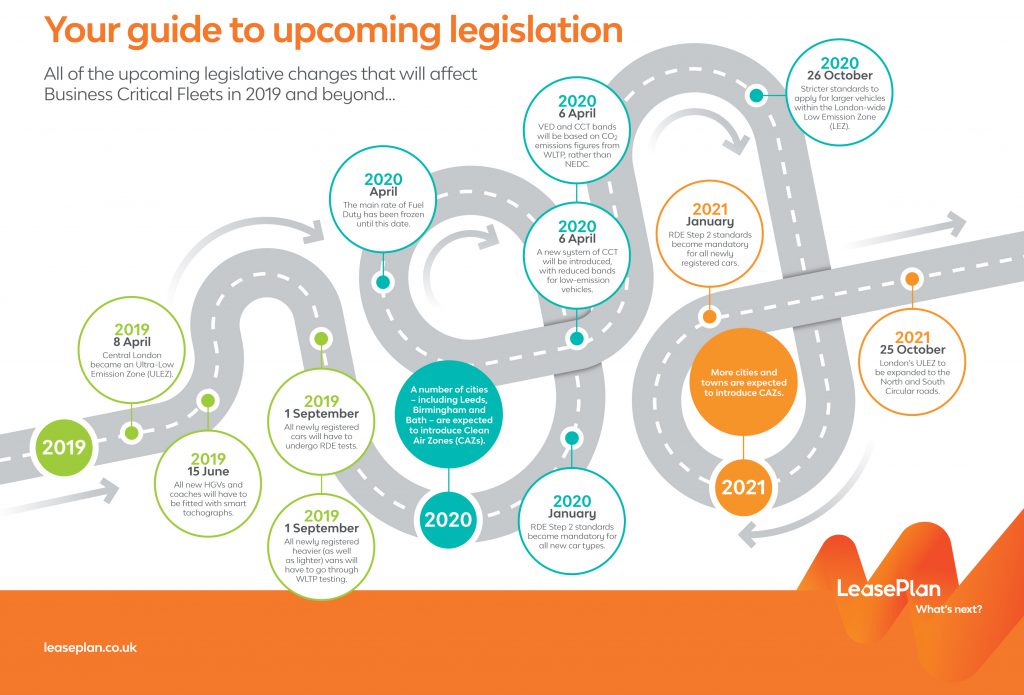

A lot has happened recently for fleets – and there’s even more on the way. Check our timeline to make sure you’re on top of everything.

Guide - 2 min read

The Government’s draft Finance Bill confirms the new Company Car Tax (CCT) rates for 2020-21 and beyond. View the new tables here.

4 min read

Ahead of the draft Finance Bill, the government has announced new Company Car Tax (CCT) rates for 2020-21 and beyond. Here’s LeasePlan’s guide.