In his Spring Budget in March 2017, the Chancellor revealed that the Government was considering changes to the taxation of diesel vehicles – specifically around the Vehicle Excise Duty (VED) rates for new diesels. Further changes were introduced in Autumn Budget in 2017.

When are the changes happening?

The changes will apply for all vehicles registered from 1st April 2018.

Which vehicles are impacted?

This change only applies to diesel cars registered from 1st April 2018. The rules for petrol cars, commercial vehicles and older vehicles aren’t changing, though rates for these type of vehicles are also increasing.

The changes just apply to diesel vehicles that do not meet the ‘Real Driving Emissions Step 2 (RDE2)’ standards, but nothing does at the moment. It’s also unlikely that the RDE2 test will be available before 2019.

What are the changes?

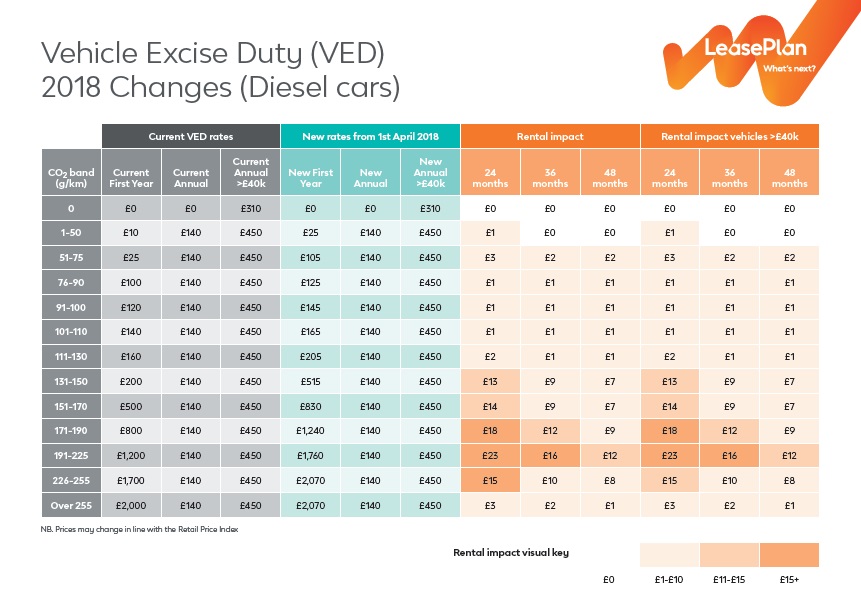

The Government’s rules aren’t always that straightforward, but this one is surprisingly simple. If a new diesel doesn’t meet the RDE2 standards, it goes up a band in the ‘New First Year’ VED table.

For example, a diesel car with emissions of 110 g/km is in band 6. This would normally have a charge of £145, but as it doesn’t meet the standards, it moves to band 7 and is charged £165.

How do I find out further information?

You can download a copy of the Vehicle Excise Duty Changes here – if you have any further questions please speak to your LeasePlan Account Manager who will be happy to help.