We knew that Budget 2020 was going to be big. It was, after all, the first of the new government – and the first since Britain officially left the EU and then succumbed to the coronavirus outbreak.

But, even so, we were a bit surprised at how big Budget 2020 was for fleets and motorists. This one had it all: new company car tax (CCT) rates, Vehicle Excise Duty (VED) changes, infrastructure investment, and even another Fuel Duty freeze. Here are the key questions and answers.

Another Fuel Duty freeze?

Yes, it had been speculated that the Chancellor, Rishi Sunak, would finally raise the rate of Fuel Duty, not least because the government is committed to bringing forward the ban on new petrol and diesel vehicles sales to 2035. In the end, though, he did nothing of the sort. Fuel Duty will be frozen at 57.95 pence a litre for the tenth consecutive year, until at least April 2021.

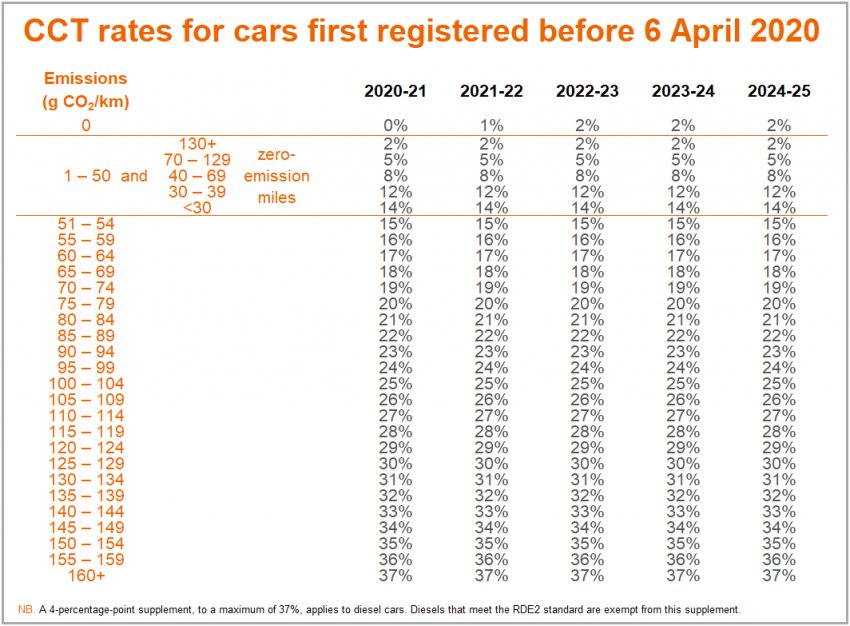

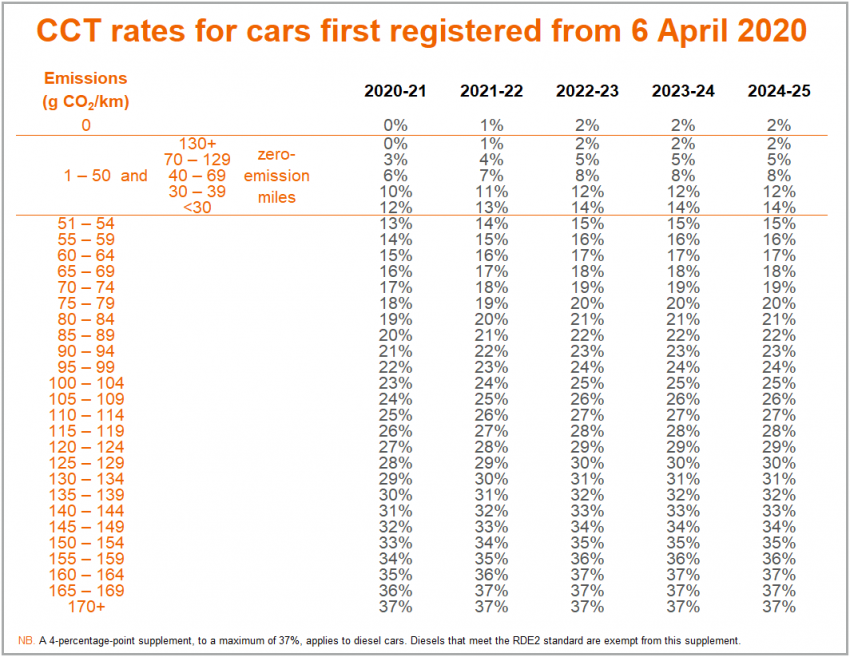

What are the new Company Car Tax (CCT) rates?

We knew the CCT rates for 2020-21, 2021-22 and 2022-23 before the Budget was published – because they were actually announced last July. But, due to the collapse of Theresa May’s government and then the general election, those rates were never signed into law.

This Budget confirmed those rates and then revealed that the rates for 2022-23 would be frozen into 2023-24 and then into 2024-25.

Were there any other tax changes?

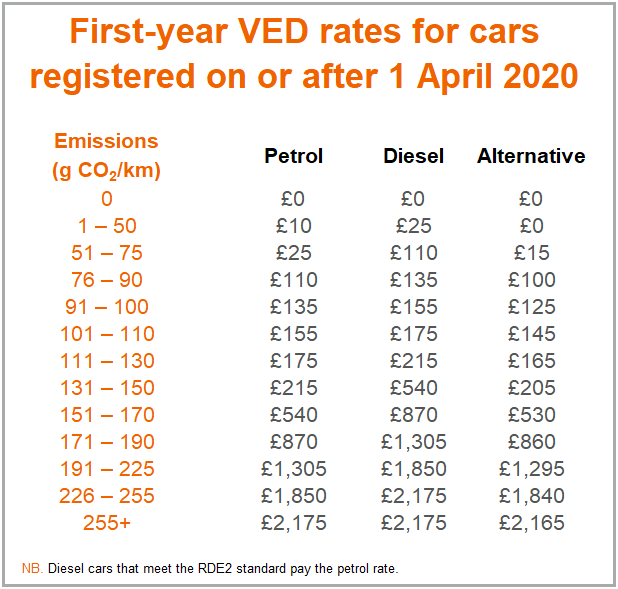

Vehicle Excise Duty (VED) also came in for a lot of attention in the Budget. The bad news is that it will be increased in line with the RPI measure of inflation from 1 April 2020 – which is rather short notice. Here are the new first-rates:

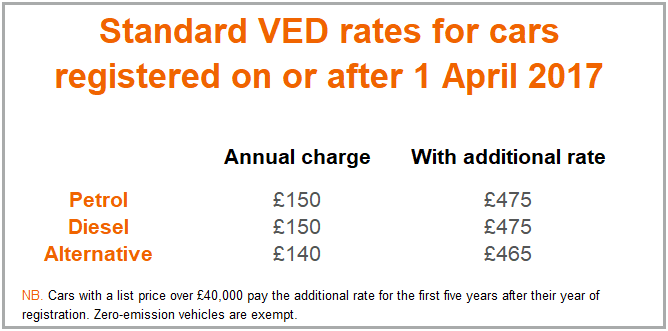

The better news is that zero-emission vehicles costing over £40,000 will now be exempt from the “expensive” car supplement of £325 that applies in subsequent years. Here are those rates:

Intriguingly, though, the Chancellor hinted that this isn’t the end of his VED changes. He also published a call for evidence on how the government “can use VED to further encourage the uptake of zero and ultra-low emission cars”.

First year VED rates for cars registered on or after 1 April 2020

What about the Plug-in Car Grant?

The Plug-In Car Grant (PiCG) was due to run out of funding this April, and there had been speculation that the government would simply allow it to dissapear, but the Chancellor managed to find another £403 million to keep it going. It will now be extended to 2022-23.

However, the grant will now be less generous. It has been reduced from £3,500 to £3000 against the cost of certain low-emission vehicles – with immediate effect.

To see what other grants are available to help you go electric, take a look here.

Anything else for electric cars?

The Budget committed an extra £500 million, spread over the next five years, to help deliver a Conservative manifesto pledge that “drivers will never be further than 30 miles from a rapid charging station”. It also exempted zero-emission vans from any van benefit charges.

Is there anything else I should know?

The Budget also committed an extra £27 billion to road improvements, dedicated £2.5 billion to filling in potholes, and changed some of the business allowances for low-emission vehicles.

Tune in to find out more

To discover more about these policies, please read LeasePlan’s Guide on Spring Budget 2020, or listen to the latest analysis from Matthew Walters and Caroline Sandall in our Fleet Navigator podcast series.