Spring Statement 2022 had previously been billed as little more than an update on the latest economic and fiscal forecasts. The Chancellor, Rishi Sunak, would simply stand up for a few minutes and let us know what the Office for Budget Responsibility (OBR), the Government’s independent forecasters, expect for the next few years.

But as the day – today – drew closer, it became clearer that Sunak would have to do something more. The crisis in Ukraine, as well as its effects on the cost of living, meant that genuine legislative action was required. The Statement was suddenly sounding more like a Budget.

As it turned out, Sunak delivered something in between the slimline Statement he originally planned and a full-blown Budget like the one he delivered last October. It didn’t contain many new policies – and certainly not many for fleets and drivers – but those it did contain were quite significant. Here’s our summary of what you need to know.

Economic growth: who knows?

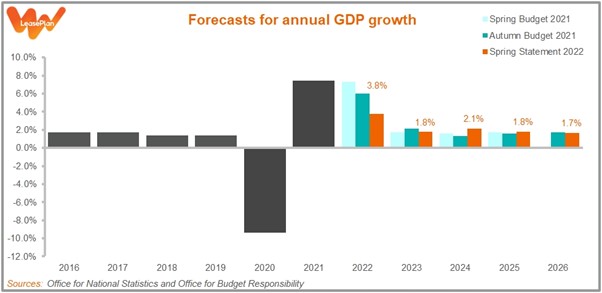

Let’s start with the forecasts that Sunak originally wanted to focus on – and particularly those for overall growth in the economy.

As you might expect, given the geopolitical situation as well as the persistence of the Omicron variant of Covid-19, the OBR has mostly downgraded the growth forecasts that it made at the time of the Autumn Budget. This year, for example, it now anticipates that the economy will grow by 3.8%, compared to the 6.0% that it previously reckoned. Next year, it’s 1.8%, down from 1.8%.

There are some upwards revisions in subsequent years, but only small ones – and they do not alter the OBR’s expectation that the UK economy will grow by around 1.5% to 2% a year in the medium-term.

Besides, both the OBR and the Chancellor himself are eager to emphasise that these forecasts may be substantially downgraded again by the time of the next Budget, due to the current uncertainty of the situation in Ukraine. Indeed, Sunak was unusually blunt in warning that “we should be prepared for the economy and public finances to worsen – perhaps significantly”.

Inflation: Getting worse

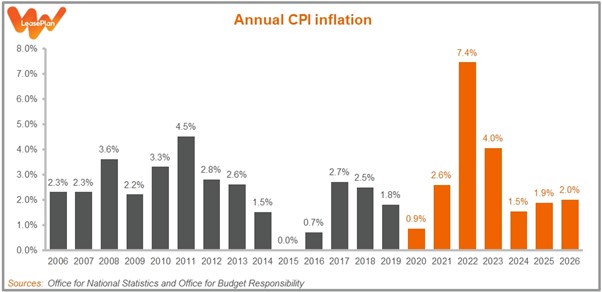

The more immediate economic problem for the Chancellor – and for all businesses and individuals – is the cost of living.

Back in October, the OBR had forecast that the main measure of inflation, the Consumer Price Index (CPI), would increase by 4% this year. Now it forecasts a whopping 7.4% rise, which would be the highest annual level of inflation for about 40 years. It then foresees a fairly hefty 4% rise in 2023, before the numbers simmer back down to more normal levels in 2024 and beyond.

Potentially compounding the issue, the growth in average earnings is now expected to lag behind inflation in both 2022 (when, according to the OBR, average earnings will rise by 5.3%) and 2022 (2.8%). And all that, of course, is before the effects of the war in Ukraine are fully taken into account.

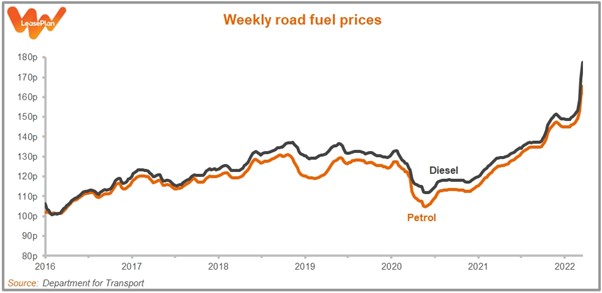

Fuel Duty: A temporary measure

The Chancellor had just one policy specifically for motorists – but it caught the eye. After over a decade of Fuel Duty freezes, the main rate for petrol and diesel is being cut by 5p, from 57.95p a litre to 52.95p, with immediate effect. According to Sunak, this cut will remain in place until March next year.

At a time of record pump prices, and rising costs all round, this is welcome relief for fleets and drivers. But it’s also the case that, due to those record pump prices, the relief may be even more temporary than Sunak intends. As the graph above shows, both petrol and diesel prices have risen by more than 5p a litre over the past week. If that trend continues, then costs could be back to where they were before today’s Statement in just a few days.

What’s more, the Chancellor knows he has to give more serious thought to Fuel Duty in the months and years ahead. As we pointed out in our preview post, the Government is already thinking about a future in which, thanks to more and more people getting to electric vehicles, the revenues from Fuel Duty are going to decline – yet it hasn’t revealed anything of its plans yet.

It had been thought that today’s Spring Statement could begin the process of changing to a new major form of motoring taxation – such as Road Pricing, by which drivers are charged for using particular stretches of road – but that didn’t turn out to be the case.

Other taxes: What we know…

Tax cuts were definitely a major theme of the Statement. Alongside the Fuel Duty change, there were also significant reductions to various other taxes, including: a £3,000 raising, this July, of the earnings threshold at which people have to make National Insurance Contributions, so that it matches the starting threshold (of £12,750) for Income Tax; and a 1 percentage point cut, from 20% to 19%, of the main rate of Income Tax in 2024.

These measures, and more, were enshrined in the “Tax Plan” that was published alongside the Budget – what Sunak describes as his “vision for a lower tax economy”. The Chancellor intends to reduce the overall tax burden on businesses and individuals over the course of this Parliament.

This may seem like a bold stance for a Chancellor who is contending with economic challenges and – by his own admission – the potential for the numbers to deteriorate rapidly. But the OBR is clear that “the public finances have emerged from the pandemic in better shape than expected,” and there is indeed another £30 billion of “headroom” before Sunak risks missing his fiscal targets.

…and what we don’t

For all of its largesse, however, the Tax Plan is a slight document – of only 6 pages, if you don’t count the covers – and it leaves many questions unanswered and details unconfirmed.

Particularly frustrating for fleets and motorists is the absence, from the Plan or from any of today’s supplementary documents, of Company Car Tax (CCT) rates for 2025-26 and beyond. Previously, Sunak had given us plenty of warning about new rates, which meant that fleets entering into three- or four-year contracts could plan their finances adequately. But now, unless something is published in the next few weeks or months, that system is at risk of breaking down.

And then there are all the other tax reviews and consultations that were announced in previous Budgets but that have since gone quiet. These include reviews into Vehicle Excise Duty (VED) for vans, VED for cars, and the possibility of a Zero Emission Vehicle (ZEV) Mandate for vehicle manufacturers. The Spring Statement offered Sunak a chance to move some of these policies along, yet he announced nothing.

For now, we should remember that this Statement was originally intended to be a slender affair – and excuse some of these omissions. But the Chancellor needs to start filling in some of the details soon if fleets and drivers are to prepare for the future of motoring.