On Wednesday 8th March, Philip Hammond will deliver his first Budget as Chancellor. But let’s not get too excited. It’s unlikely that this Budget will be as significant as his Autumn Statement from December, which established the fiscal parameters of Theresa May’s Government. Nor will it contain as much of relevance for fleet professionals, now that policies such as the Salary Sacrifice and Company Car Tax (CCT) changes have been revealed. However, as with any Budget, there are still a lot of things to look out for. Here is our top five.

1. The new growth figures.

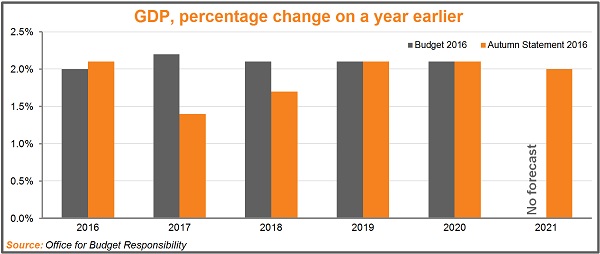

Hammond had bad tidings at the Autumn Statement: the Office for Budget Responsibility (OBR) had, in response to the EU Referendum, downgraded its expectations for economic growth over the next two years. As our graph below shows, the forecast for 2017 went from 2.2% to 1.4%, whilst the one for 2018 went from 2.1% to 1.7%.[i]

However, there may now be some improvement. According to the Financial Times, the OBR is expected to upgrade its forecast for 2017 to about 2%, and perhaps there will be upgrades for future years too.[i] These numbers have important ramifications across the rest of Hammond’s Budget. Stronger growth means more economic activity, which in turn makes it easier for the Chancellor to achieve his fiscal targets.

But it’s not just Hammond who would benefit from this. If the nation’s finances are in a better position, then there’s less requirement for the Government to raise taxes and cut spending. In theory, this means that the Treasury’s squeeze on our wallets – which many fleet professionals have experienced through, for example, rising Company Car Tax (CCT) rates – needn’t continue for so long.

2. Inflation on the rise.

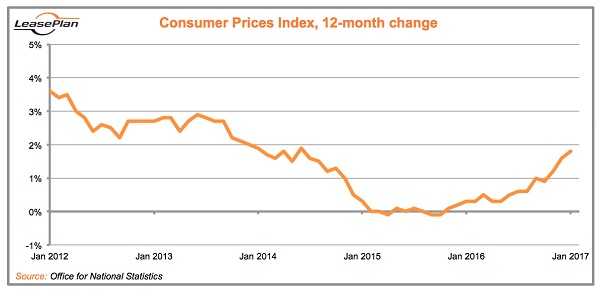

Other changes to the official forecasts may not be quite as heartening. As we mentioned in our special Autumn Statement briefing, the fall of the pound after the Brexit vote is one of the major factors pushing up inflation.[iii] Our graph shows that prices rose by 1.8% in the year to January.

Prices are rising faster than the OBR expected in November, when they predicted inflation of 2.3% in 2017 and 2.5% in 2018, so they are likely to correct themselves this time around. Some observers even believe that inflation will rise to 3% this year.[iv]

These price increases affect all of us, including motorists. Indeed, a litre of petrol has gone up by 19 pence in the last 12 months, whilst for diesel it’s 22 pence.[v] Controlling the cost of living is likely to be one of Hammond’s greatest challenges.

3. Business rates.

Many of our customers will pay the business rates that are levied on non-domestic properties such as shops and offices. Which means that many of them will be affected by the Government’s plan to revalue the properties that are subject to those rates, which is explained here.[i]

This revaluation has been a long time coming. The last one came into force in 2010, and another was due in 2015, but it was pushed back to this April by George Osborne. The fear that some businesses could soon face higher tax bills has led Conservative MPs and others to lobby the Chancellor for help.

How will Hammond respond? He’s already indicated that he’s ‘alive’ to these concerns[ii], as well as sceptical about a system of business taxes based on property values in an age of internet shopping, but we will have to wait for the Budget itself to see whether he’ll actually make any changes.

4. Plug-in Car Grant.

The Autumn Statement was full of policies affecting motorists, from the Fuel Duty freeze[vii] to the Salary Sacrifice changes[viii]. The Budget is unlikely to contain as much, but there are some questions that Hammond could address. One of these concerns the Plug-in Car Grant. As it currently stands, this grant offers 35% off the cost of an electric car, up to a maximum of £2,500 for most ultra-low emission vehicles and £4,500 for those that can run with zero emissions for 70 miles or more.[ix] But these rates are due for review this month, and there’s also the separate question of whether the scheme as a whole will continue beyond March 2018.

5. Other policies for motorists.

In his Autumn Statement, Hammond made big changes to the fiscal calendar. After this week’s Budget, we will only get slimmed-down ‘Spring Statements’ in March, with the main Budgets moved to the autumn. This creates uncertainty around the sorts of policies that have traditionally been announced in March, including Fuel Duty and future CCT rates. Will Hammond still present these measures in his last ever Spring Budget? Or will we have to wait until autumn? We should find out what the new timetable is on Wednesday.

Find out more:

LeasePlan’s Head of Consultancy Matthew Walters will be sharing his insight and commentary will be provided on the day via our Twitter account @LeasePlanUK

Sources:

[i] Office for Budget Responsibility, Economic and fiscal outlook, 23rd November 2016

[ii] Chris Giles, Financial Times, ‘UK Budget to reveal sharp upgrade in economic forecasts’, 3rd March 2017

[iii] LeasePlan Consultancy Services, Autumn Statement Briefing Document, 25th November 2016

[iv] HM Treasury, Forecasts for the UK economy: a comparison of independent forecasts, 15th February 2017

[v] Department for Business, Energy & Industrial Strategy, Weekly road fuel prices, 28th February 2017

[vi] Ben Riley-Smith, The Telegraph, ‘Business rates blow to be ‘softened’ in the Budget’, 20th February 2017

[vii] Matt Dyer, LeasePlan, ‘Autumn Statement: Fuel Duty’, 23rd November 2017

[viii] Matthew Walters, LeasePlan, ‘The Salary Sacrifice changes explained’, 12th December 2016

[ix] Rebecca Whitaker, LeasePlan, ‘Future-proof your fleet: Environment’, 28th October 2016