The Worldwide Harmonised Light Vehicle Test Procedure (or WLTP to its friends) may not sound particularly exciting, but it is a big deal for fleets and car manufacturers. Here’s a quick introduction to the key details.

What is it?

WLTP is a new way of measuring fuel economy and vehicle emissions (including CO2).

Why is it being introduced?

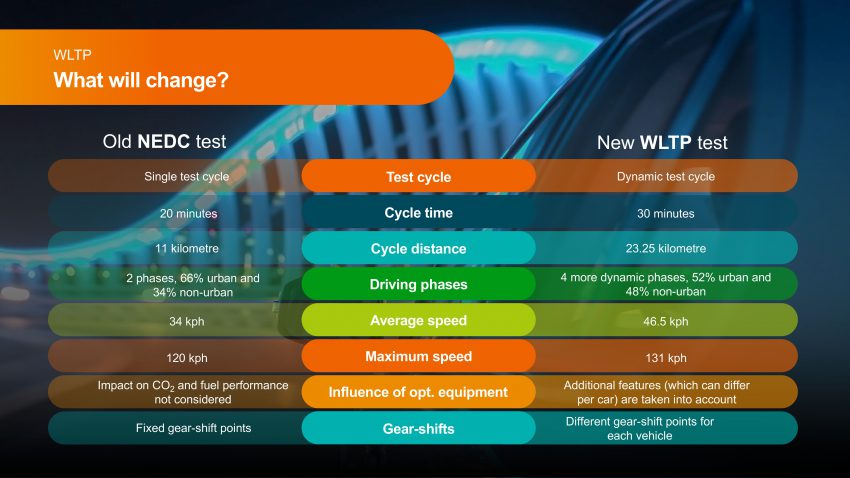

The previous test (NEDC) was becoming increasingly unreliable given developments in vehicle manufacturing, so the EU designed WLTP to provide more accurate figures derived from stricter tests.

How does it work?

WLTP uses a more stringent testing regime with more realistic conditions. These include a longer driving distance with shorter stops and more dynamic braking and acceleration, plus a lower ambient temperature. There is also simulated real-world vehicle use in four different driving environments:

- Low-speed city centre driving

- Medium-speed town or suburban driving

- High-speed driving on an A-road or dual carriageway

- Extra-high-speed motorway driving

The figures from these four scenarios are combined to create a mixed journey average for each vehicle.

Why does it matter?

Cars registered from 6 April 2020 (the start of the new tax year) will be taxed on the basis of CO2 figures provided by WLTP, rather than the previous NEDC regime.

The effects on manufacturers

This has meant manufacturers have had to spend the last year or two retesting their ranges under WLTP, so they can provide the new figures in time. This has led to backlogs in the supply of some vehicles, as well as certain models and engine types being withdrawn completely.

The effects on fleets

As it is a more accurate reflection of vehicle usage, it’s likely that many CO2 figures will be higher, which could push the cars into higher road tax and company car tax rates. In fact, identical cars registered hours apart on the 5th and 6th of April could have a significant difference in the company car tax that has to be paid.

However, we would encourage customers not to be too concerned. The fine detail is not available yet and it looks like there are some impressive developments in the pipeline, such as next-generation engines that could cut CO2. The UK government has also reduced future company car tax rates to mitigate, in part, against the effects of WLTP. It’s a bump in the road, undoubtedly, but we will get past it – and LeasePlan will provide you with full support throughout this journey.

Specific challenges

Alongside the potential for a general rise in costs, we have identified two specific challenges for our customers that we are working to resolve. First, there could be a significant effect on vehicles ordered before the deadline that are delivered afterwards, which may need to be reflected in a company’s vehicle policies. We will, of course, provide all the support that we can.

Second, we will not have a correct CO2 value for all vehicles at the point when we quote them, as the tests also take vehicle options into account. To address this, we are currently developing a dynamic quoting system that will allow us to provide an accurate CO2 figure within 24 hours of an order being placed.

Government changes

The Government has recognised the potential impact of this change, so company car tax rates for cars registered from 6 April will drop by two percentage points in the 2020/21 tax year before rising back by one percentage point each year for the next two years.

The new rules also include strong incentives for people to move towards zero emission vehicles (and some plug-in hybrids) as these will have much lower company car tax rates.

Find out more

If you’d like to know more about WLTP, and the linked RDE2 test, please click here