But, from the perspective of fleets and motorists, this Budget was relatively slender when compared to its immediate predecessors, and certainly not as significant as it might have been. There are a lot of big questions hovering over Britain’s roads at the moment, as we collectively make the transition to electric vehicles. Very few – if any – of them were answered today.

Yet this doesn’t mean that there was nothing in the Budget for fleets and motorists. Far from it. Here’s our summary of the key points.

Economic growth: Weak strength

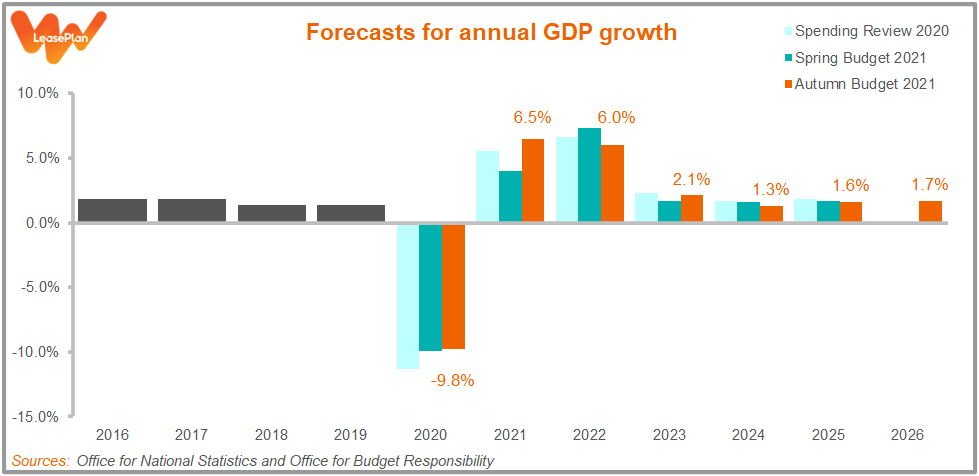

It’s always worth starting with the Office for Budget Responsibility’s forecasts for economic growth, which are published alongside the Budget itself. Not only do they underpin much of the Chancellor’s fiscal tinkering, but they also indicate what sort of economic environment we’ll all be occupying in the next few years.

The good news is that the OBR expects the UK economy to bounce back quite quickly after the challenges of the past two years. It’s upgraded its growth forecast for this year quite markedly, from 4.0% at the time of the last Budget to 6.5% now. And while the forecast for next year has been downgraded, from 7.3% to 6%, that’s still strong growth overall.

As Rishi Sunak put it in his Budget speech, “[The OBR] forecast the economy to return to its pre-Covid level at the turn of the year – earlier than they thought in March.”

But it’s not all good news. After the next couple of years, economic growth is expected to simmer down to a much less impressive level – around the 1.5% mark. This is, of course, better than the economy sinking into recession, but it can’t really be described as world-beating.

And, remember, the forecasts for the next couple of years and beyond are subject to a huge degree of uncertainty. Thanks to the ongoing effects of the pandemic and of Brexit, it’s very possible that the OBR will have to downgrade its expectations in the near future.

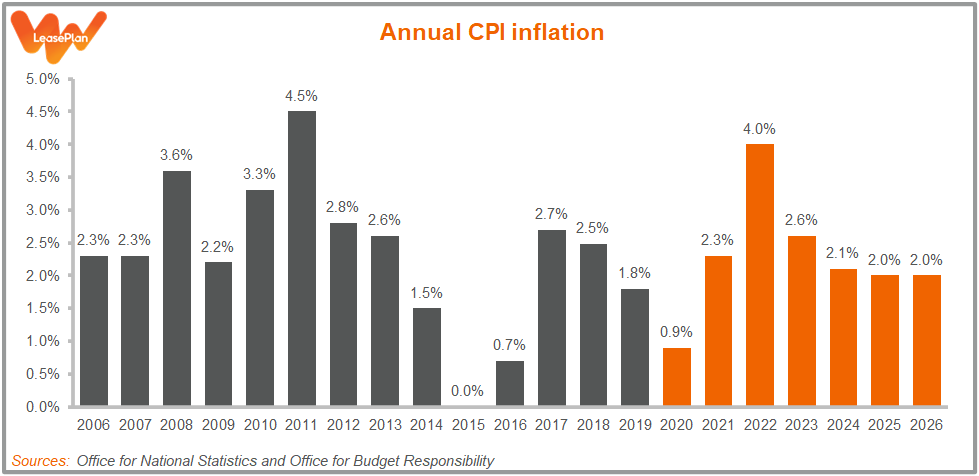

Inflation: The new concern

Sunak led his speech by talking about inflation, and with good reason: thanks in large part to supply problems brought on by the pandemic, the cost of living is going up, up and up. In fact, the OBR now expects that the main measure of inflation, the Consumer Prices Index (CPI), will rise by an average of 4% next year, which is twice the level targeted by the Bank of England.

Motorists are already feeling some of these effects at the pumps: at over 140 pence a litre, petrol prices are currently at their highest since 2012 – and are likely achieve new record highs in the weeks ahead.

But there is some relief anticipated: the OBR forecasts that the growth in average earnings – at 3.9% next year and 3.0% the year after – will mostly keep pace with inflation.

Fuel Duty: Light relief

Ahead of this year’s Spring Budget, there was speculation that, in order to pay off some of the money that he’s spent during the pandemic, the Chancellor would increase the main rate of Fuel Duty by 5 pence a litre. Thankfully, that didn’t happen – he instead extended the Fuel Duty freeze until April 2022, keeping it at 57.95 pence a litre for the 11th year in a row.

But what would he do this time around? Well, the same again. In Autumn Budget 2021, the freeze has once again been extended, until at least April 2023.

Overall, this is good news for fleets and motorists, particularly at a time of rising prices all round. But we can’t help but note that, at a time of near-record fuel prices, the Chancellor’s benevolence comes to mean less and less. Petrol and diesel are going to continue to be expensive, with or without the Fuel Duty freeze.

Road to Zero: More progress

We are only days away from COP26, the big global climate conference that’s taking place in Glasgow this year. And we’re less than 9 years away from the government’s 2030 ban on the sale of new conventional petrol and diesel cars and vans. The transition to electric vehicles has to happen apace.

Autumn Budget 2021 didn’t contain any new tax measures to help hasten this transition, but it did do some spending. A further £620 million has been made available for “public charging in residential areas and targeted plug-in vehicle grants”. And a separate £817 million has been set aside “to support investment in zero emission vehicle manufacturing, gigafactories and the electric vehicle supply chain”.

The Budget doesn’t confirm what “targeted plug-in vehicle grants” will benefit from the extra money, but the wording of that passage does reflect the text of a report that the government published in the summer, called Transitioning to zero emission cars and vans: 2035 delivery plan. That document suggested that the Electric Vehicle Homecharge Scheme, the main grant for residential chargers, will next year be refocused on “renters, leaseholders and those living in flats”.

Taxes: What we know (and what we don’t)

The Budget contained a scattering of announcements on motoring taxation. There was the Fuel Duty freeze, of course, as well as confirmation that Vehicle Excise Duty (VED) rates for cars and vans will increase in line with RPI inflation next year. The Chancellor also froze VED for HGVs and suspended the HGV road user levy for another 12 months.

But fleets and motorists might have expected a lot more. As we pointed out in our preview of the Budget, there are currently a lot of big reviews into motoring taxation – including on the overall VED systems for both cars and vans – that have passed through consultation and then… nothing. We’re still waiting for the actual policy announcements.

What’s more, in advance of the Budget, the government had talked about Fuel Duty – and how, as more of us move into electric vehicles, that tax might not be a suitable way of raising revenue for the Exchequer. There had been speculation that the Budget would kickstart a long-term review of alternative revenue-raising measures to cover both fossil-fuelled and electric vehicles, such as some form of Road Pricing. However, again, nothing.

Of course, there are many more Budgets to come, starting with next year’s Spring Budget. But the government cannot postpone all these questions indefinitely. If fleets – and, indeed, all drivers – are to prepare for the future, then it would help to know what that future looks like.