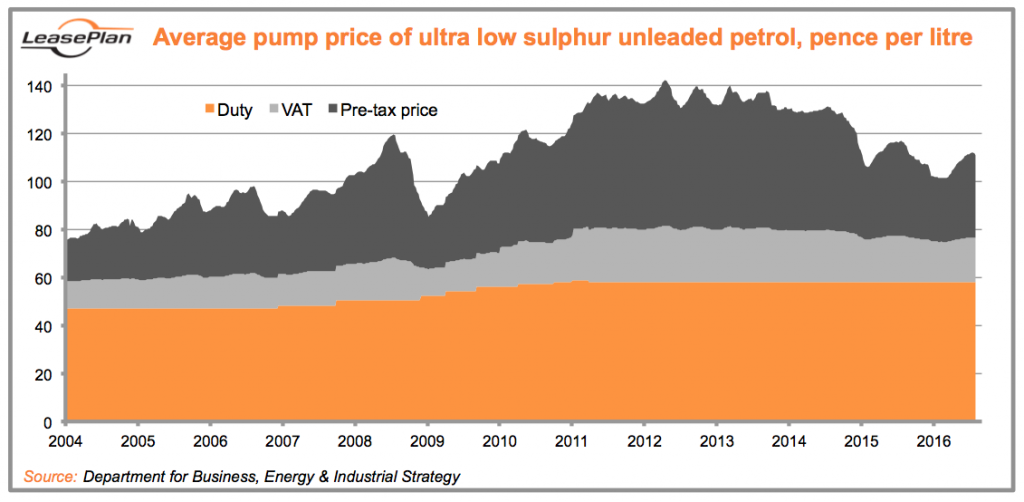

57.95 pence a litre. That is the current rate of Fuel Duty, and that’s what it has been since March 2011. This is a tax that seems to be in a perma-freeze.

But, make no mistake, Fuel Duty is still a hot topic. As our graph above shows, it accounts for roughly half of everything we spend at the petrol pump. From its establishment in the early days of the motor car, through to the rate hikes imposed by former Chancellors such as Norman Lamont and Gordon Brown, and on into the uncertain electric future, Fuel Duty has always captured our minds and our wallets.

LeasePlan Consultancy Services have created a Fuel Duty Briefing which covers:

- What is Fuel Duty? Here are the basics about this tax that almost all motorists pay.

- A modern history of Fuel Duty. From Norman Lamont’s introduction of the road fuel escalator in 1993 to George Osborne’s numerous freezes, this is Fuel Duty in chronological terms.

- Fuel Duty today. How is the policy currently implemented? And how much money does it raise for the Government?

- The future. Some observers think that Fuel Duty is on the wane. We explain their reasons why.

We’ve produced this document, alongside other briefings on Budget 2016 and the Diesel Debate, for a very simple reason; we see it as our responsibility to keep you informed about all the things that matter in motoring. That way, you will be better positioned to make the best decisions for your fleet.

Download the LeasePlan guide to Fuel Duty Briefing here: FUEL DUTY BRIEFING

For further information please speak to your LeasePlan Account Manager or a member of the LeasePlan Consultancy Services team on :

Tel: 0344 371 8032

Email: consultancyservices@leaseplan.co.uk